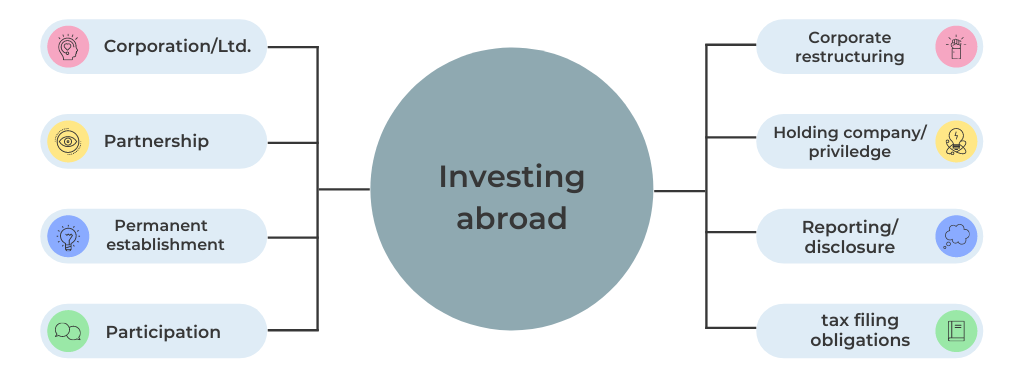

Investing abroad

The intention is clear – put your footprint onto new territories. That means that you will invest either in an existing company or set up your own box.

We will provide a clear guidance what kind of legal frame is best and at what cost it can be installed and maintained. Of course we share your optimism that there will be profits once your venture abroad flies. Based on profits the question to be answered is who to keep the local tax ratio low and how to repatriate profits. But we will also take a look on what happens if plans fail. It is good to know how to reduce taxable profits in your own p&l if your investment has to be written off. Whether investing in Germany, the United States of America, in France or in Switzerland – the legal frames of a corporation or a partnership or a permanent establishment are common ground.

The road to take depends on your own legal entity and will take into account, among others, whether equity or loans will finance the expansion, what yearly statutory obligations have to be fulfilled and whether the respective local disclosure requirements in your target country may affect your own tradition in disclosing or not disclosing relevant issues from your own company.

In the end we will provide a clear recommendation whether to proceed with a corporation or a partnership or with a permanent establishment. And with that we will inform you about the taxation of your funding, of profits and losses abroad and related to the investment in your own profit and loss statement and eventually about the current obligations to fulfill vis à vis the fiscal authorities in your target country.